ANNUAL ADVISORY FEE

Advisory fees are billed quarterly and debited from the managed account. Clients may arrange other fee payment methods with FPLCM if they would like, such as paying the annual fee (paid in full) via check.

FPLCM offers an alternative fee structure, if applicable. FPLCM will charge 0.70% on AUM until the fee exceeds the flat annual fee for the selected service package.

In addition to the advisory fee, clients may be subject to custodial fees such as transaction fees associated with the purchase and/or sale of securities. Please refer to the Custodian Comparison PDF for more information regarding transaction fees.

Clients requesting additional (non-managed) accounts to be opened such as a checking account may be subject to a one-time, set up fee of $250.

Estates are typically subject to an estate processing fee of $1,500-$5,000.

Households over $20 million may incur an additional surcharge fee of $5,000 per $10 million or increment thereof after $10 million.

Additional wealth management services may be subject to additional fee of $250/hour.

INVESTMENT POLICY STATEMENT

We construct an Investment Policy Statement for each client/household to provide the following:

- Establish a clear understanding of the client’s investment objectives, time horizon and risk tolerance

- Offer guidance regarding the investment of assets

- Identify target asset allocations

- Establish a basis for evaluating investment results

PORTFOLIO REBALANCING

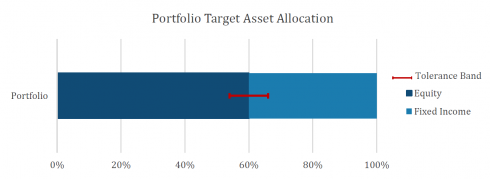

We utilize a tolerance-based system for rebalancing when a position deviates too far from its target allocation. The tolerance-based system uses tolerance bands based on a specific percentage, typically 10% for major asset classes. The chart below shows an example of a portfolio allocated to 60% equities. The portfolio would only require equity rebalancing if the equity allocation exceeded the tolerance band threshold by either increasing to 66% or decreasing to 54% of the portfolio allocation.

These rebalancing procedures also apply to sub-asset classes (20% tolerance band) in the allocation and our monitored daily by our portfolio management system. Typically, minor rebalancing is only necessary once every 9 to 12 months and does not cause significant capital gains issues.

PORTFOLIO REPORTING

Client will receive performance reports quarterly via the Client Portal. Our performance reports are generated utilizing industry recognized Orion software. Reports will display holdings and performance relative to an appropriate blended benchmark index amongst other metrics. Please click here to view a sample performance report.

COMMUNICATIONS (REVIEWS & CALLS)

Semiannual reviews are scheduled quarterly based on the client’s anniversary date. Clients participating in the upcoming quarter reviews will receive an email with a link to schedule near quarter end of the prior quarter. Ex: A client whose anniversary date is March 1st will schedule their reviews during Q1 and Q3. Quarterly calls are scheduled at the client’s convenience. All other routine client service needs and requests are performed throughout the calendar year as they occur.

ASSET LOCATION

Implementing the portfolio recommendation in a tax-efficient manner can enhance returns by utilizing an asset location strategy. Asset location is the distribution of investments to the most tax-efficient account type based on the tax impacts of each investment.

The general concept is to place the least tax-efficient holdings into a tax-sheltered account and to hold the most tax-efficient securities in taxable accounts. For example, we recommend placing investments whose dividends are taxed as ordinary income into a non-taxable account to avoid higher ordinary income tax rates for the client. In some cases, we may advise distributing holdings of a model across two different types of accounts.

INTERVAL FUND ACCESS

Interval mutual funds are a hybrid between traditional mutual funds and private funds. Interval funds have limited liquidity; investors may redeem their shares quarterly. Investors can typically invest daily, although some allow entry less frequently.

The limited liquidity feature provides fund managers with the ability to invest in less liquid investments, such as investing in private real estate or private credit funds. Many risk averse investors are attracted to these investments because they typically have low correlation and lower volatility than the capital markets.

CONCIERGE SERVICES

FPLCM offers concierge services to Level 4 and 5 clients. The minimum level of service required will be determined based upon the estimated concierge hours required.

PRIVATE FUND ACCESS

FPLCM offers access to private funds that have been successfully vetted through our due diligence process. In many cases, the minimum investment requirements and/or admin fees have been waived for clients.

The three areas of private funds which we offer are:

- Private credit

- Private equity *

- Private equity real estate

Many risk averse investors are attracted to these investments because they typically have low correlation and lower volatility than the capital markets. Additionally, many private funds offer attractive returns, tax efficiency, and relatively high and stable income. Another characteristic of private funds is limited liquidity; the level of liquidity is fund specific, ranging from daily to extended periods of time.

Level 3 clients are restricted to 2 evergreen private fund holdings (limit: 2 purchases per 12 months).

*Private equity funds are only available to Level 4 & 5 clients.

ADDITIONAL INVESTMENT STRATEGIES

In addition to our model portfolios, we offer the following strategies:

- Leveraged ETF strategies

- Tactical equity models

- Hedged overlay equity strategies

- Individual stock portfolios

We also provide accommodations for transitioning existing individual stock portfolios of new clients to their Investment Policy Statement allocations— minimizing tax consequences. We will monitor/evaluate stocks utilizing Ford Equity Research data.