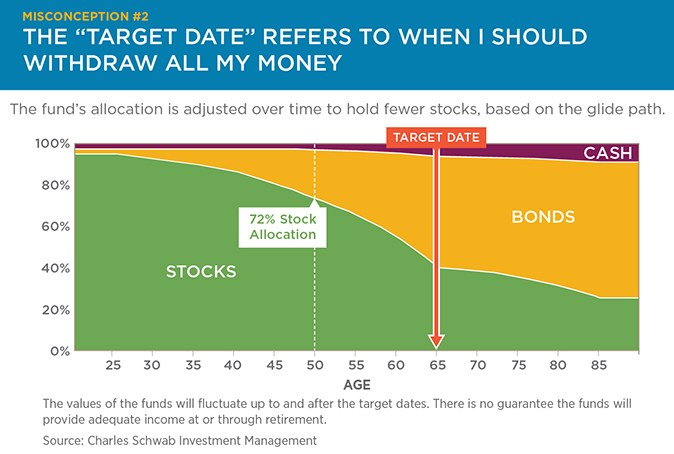

Not true. The “target date” refers to the year you plan to retire—and when you’ll stop making contributions and can start taking withdrawals. That year also determines the mix of investments in the fund over time: The percentage of stocks in the portfolio decreases as you approach retirement, so you’re exposed to less risk. For example, a Schwab Target Fund may be 72% stocks when you’re 50, and it will continue to become more conservative, with approximately 40% in stocks by the target date. Schwab Target Funds, whose asset allocation formulas—or glide paths—go well past the target date (see above), are designed to offer the potential for ongoing growth. This helps to lessen the chance that you’ll outlive your money, while still seeking to reduce risk over time.