Reduce Your Retirement Plan Fees by 30% to 40% on Average While Lowering Your Taxes

We offer ERISA 3(38) fiduciary investment management services on a flat-fee basis, while most retirement plans are charged a percentage of assets under management. The flat-fee structure should most likely benefit most larger plans compared to the percentage of assets structure. Our flat annual fee is a base fee of $2,500 plus $200 per participant*.

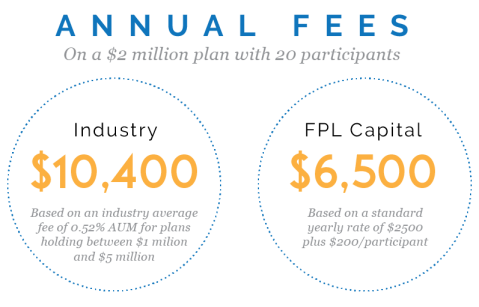

A study of 525 retirement plans recently found that the average annual fee to be 0.52% of assets under management for plans with between $1 million and $5 million in assets. For a 20-participant plan with $2 million in assets, annual fee would be $10,400.

By contrast, that same 20-participant plan with $2 million in assets would cost $6,500 under our flat fee structure. Our fee stays the same even as the plan assets grow. Also, our fee can be paid from assets other than retirement plan assets, which is generally treated as a tax-deductible expense for the plan sponsor.

Open Architecture Platform Through Vanguard Retirement Plan Access™

We provide access to a true “open architecture” 401(k) platform where each service provider can be added or removed without affecting Plan’s structure. Most retirement plans consist of bundled packages where the Fiduciary, Recordkeeper, TPA, and Custodian are provided by the same company. This bundled approach is almost never beneficial to the plan as one company may not be able to provide all these services efficiently in a cost-effective manner. On our platform, the fiduciary role will be completed by FPL Capital, while Vanguard performs Recordkeeper and TPA duties. If needed, an outside TPA can be hired. The Custodian will be Vanguard (administered byAscensus). Bundled and Unbundled fees are additional**.

Various Investment Options

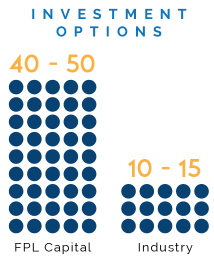

Most plans consist of a very limited number (about 10 to 15) of investment options. Usually, these investment options have high expense ratios. We design an investment lineup that consists of about 40 to 50 low-cost institutional class funds with no commissions attached. Our investment lineup includes funds from companies, such as Vanguard and Dimensional.

Self-Directed Brokerage Accounts (SDBAs)

All plans we manage offer self-directed brokerage accounts (SDBAs). Nationwide, only a small number of plans offer the self-directed brokerage account option. However, that number is slowly increasing. In 2017, 35% of plan sponsors offered SDBAs compared to 28% in 2015. SDBAs allow participants to invest in offerings that are usually not part of the core investment options of a Plan. These are more suitable for knowledgeable do-it-yourself participants who have an interest in alternative investments, such as private equity real estate, interval funds, private debt funds, and etc. SDBAs can be held at either TD Ameritrade, Schwab, or Fidelity.

Dedicated Plan Website

We will also develop and maintain a dedicated website for the plan. The website will have all necessary information regarding the plan, such as contact information, plan related paperwork, useful educational resources, etc.

| FPL Capital Management | Other Investment Managers | |

|---|---|---|

| Flat-Fee Structure | Yes | % of Assets Under Management |

| Fee Payment | Outside of Plan Assets | From Plan Assets |

| Open Architecture | Yes | Mostly Bundled |

| Investment Lineup | 40 to 50 Funds | 10 to 15 Funds |

| Institutional Funds | Yes | Mostly Non-Institutional |

| Low-Cost Funds | Always | Above Average Expense Ratios |

| SDBAs | Always | Majority Do Not |

| Plan Website | Yes | No |

*We also charge a one-time setup fee (base fee of $2,500 plus $100 per participant).

**Vanguard’s Bundled package (TPA, Recordkeeper, and Custodian) annual fee starts at $3,825, which includes the first 15 Participants. One-time setup fee of $1,500. Their Unbundled package (Recordkeeper and Custodian) annual fee starts at $2,750, which includes the first 15 Participants. One-time setup fee of $850.