Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks of bigger ones in the US. But the performance of these stocks has varied at different points in history.

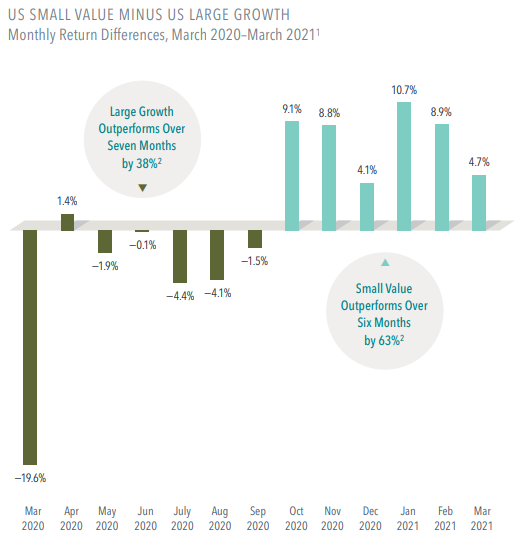

- As the global pandemic rocked markets in March 2020, large growth stocks outdid small value stocks by 19.6%, the greatest monthly margin on record. From March through September, the large growth index beat small value by a cumulative 38%.

- But history has shown that a disappointing period for a premium can be followed by a quick turnaround, and that’s what happened beginning in October 2020. Through March 2021, the small value index saw its own noteworthy outperformance: 63% over that span, among the best stretches since the 1920s.3

History hasn’t presented a reliable way to predict when small value stocks will outperform. Swings can be swift and sharp—staying invested is the best way to capture expected gains over the long term.

1. Small value minus large growth is the monthly return difference of the Fama/French US Small Value Research Index minus the Fama/French US Large Growth Research Index.

2. Cumulative outperformance over period.

3. Index data begin July 1, 1926.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

In USD.

Note: From July 1, 1926, through March 31, 2021, the Fama/French US Value Research Index outperformed the Fama/French US Growth Research Index by 2.84 percentage points on an annualized basis.

The Fama/French US Small Cap Research Index outperformed the Fama/French US Large Cap Research Index by 1.83 percentage points on an annualized basis over that period.

Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and

Nasdaq equivalents since 1973).

Fama/French US Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and

Nasdaq equivalents since 1973).

Fama/French US Small Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and

Nasdaq equivalents since 1973) that have smaller market capitalization than the median NYSE company.

Fama/French US Large Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and

Nasdaq equivalents since 1973) that have larger market capitalization than the median NYSE company.

Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP