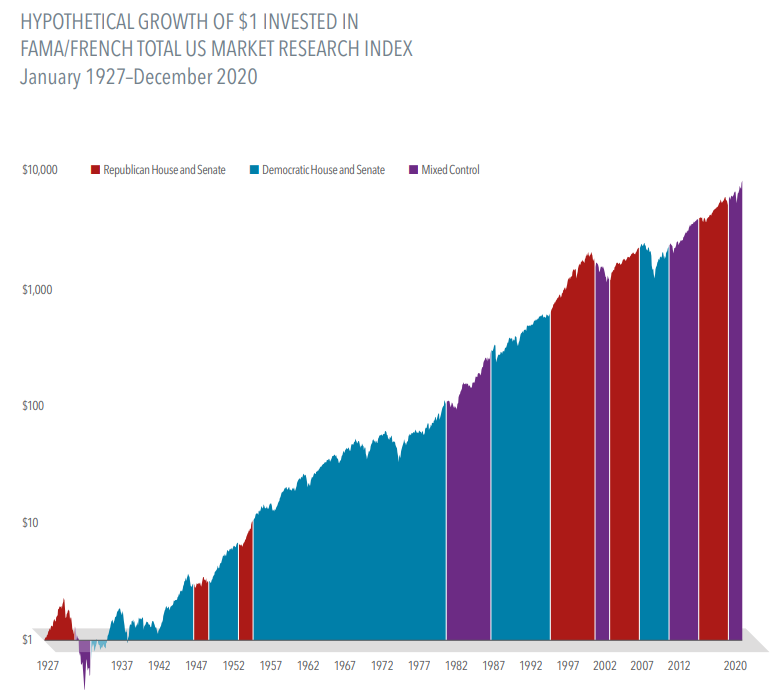

What History Tells Us About The Market and Control of US Congress

Nearly a century of US stock market returns suggests that making investment decisions based on control of the chambers of Congress is unlikely to lead to better investment outcomes.

- From 1927 to 2020, stocks trended higher regardless of whether Democrats or Republicans controlled the House and the Senate, or whether control was mixed.

- Actions by Congress and the other branches of the federal government may impact returns, but other factors like geopolitical events, interest rate changes, and technological advances do too. Decades of research suggest that current market prices incorporate all of this information.

- Shareholders invest in companies, not a political party, and companies focus on serving their customers and growing their businesses, regardless of what happens in Washington.

Stocks tend to reward disciplined investors no matter who has the upper hand in the House and Senate—a useful lesson about the benefits of a long-term investment approach.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

In US dollars. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the Fama/French US Total Market Research Index. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

Fama/French Total US Market Research Index: This value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio

is rebalanced.