Dimensional Lowers Fees on Mutual Funds and ETFs

Dimensional Fund Advisors, a global leader in systematic factor investing, will reduce management fees across 47 mutual funds and three exchange-traded funds (ETFs), effective February 28, 2022. The changes represent a 13% reduction on an asset-weighted basis1 for the impacted funds, which cover a broad range of investment solutions, from global equity and fixed income strategies to sustainability and social funds.

Throughout its history, Dimensional has continually enhanced its investment solutions and sought to pass efficiencies and benefits of scale along to clients. The firm is proactive in taking a long-term view, pricing by strategy rather than product wrapper as it seeks to deliver value over index, traditional active, and systematic active alternatives.

The move builds on the momentum of Dimensional’s successful ETF launches and mutual fund conversions over the past year. The firm’s current lineup of 13 ETFs has grown to more than $42 billion in assets under management during that time, putting Dimensional on the cusp of becoming one of the top 10 issuers by assets.

“For 40 years, Dimensional has been an industry leader in providing low-cost, diversified strategies,” Dimensional Co-CEO and Chief Investment Officer Gerard O’Reilly said. “We are committed to continuing to offer investors robust solutions that provide the benefits of indexing with the higher expected returns and increased risk management of flexible, daily implementation.”

Dimensional has a track record of regularly reviewing and reducing fees for the benefit of clients and investors. Morningstar places the majority of the firm’s management fees in the lowest decile relative to peer funds.2

“We’ve always sought to ensure our investment strategies are priced competitively across asset classes and to empower financial professionals to make the best decisions for those they serve,” Dimensional Co-CEO Dave Butler said. “Clients want the flexibility to customize solutions. By offering a growing suite of mutual funds and ETFs and expanding our separately managed accounts (SMA) offering, we feel confident that we’re well positioned to serve clients’ current and future needs.”

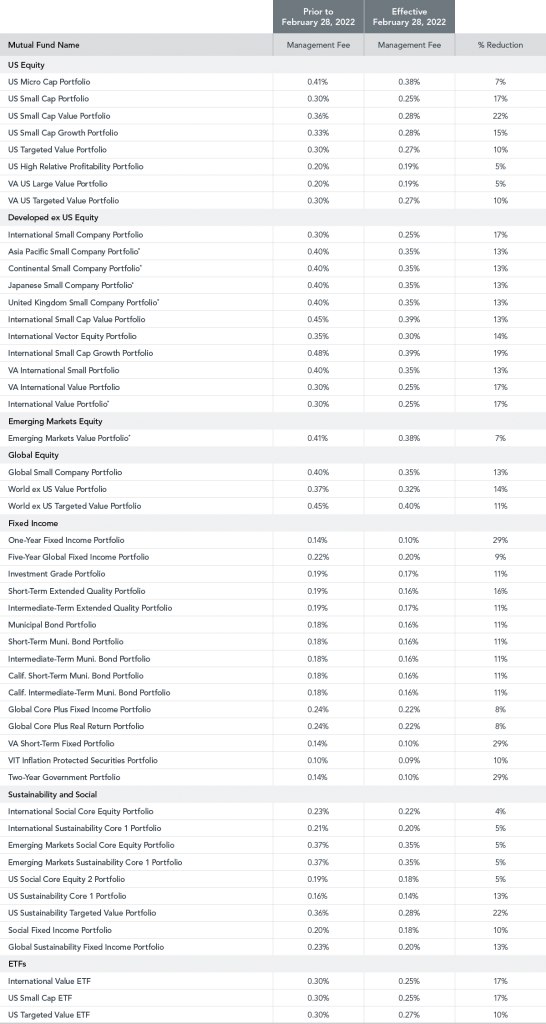

Dimensional US Mutual Funds and ETFs

1Assets used to calculate the asset-weighted average reductions were based on average assets for the fiscal year ended 10/31/2021.

2Data provided by Morningstar. The Dimensional analysis includes US-domiciled, USD-denominated open-end and exchange-traded funds as of 12/08/2021. Sixty-nine out of 123 Dimensional funds are in the lowest management fee decile within their Morningstar category.